Hi, Danya from Grats Group here. Which virtual cards are better? It is myBrocard vs PST.net vs Capitalist! Every media buyer asks themselves this question. Our team has tried to provide you with answers in this article. A little information about us: we have extensive and successful experience with gambling advertising in Google Ads, which is why we are currently operating advertising traffic in Facebook Ads. That is why we chose to enhance our knowledge of the most effective payment solutions for media buying.

We examined the most popular virtual payment card services (one that we use is included), identified all the hidden fees, and verified whether they perform well with advertising platforms.

In the course of our research, we have studied the key stages of working with payment services:

- Account creation

- Card issuance

- Linking cards to advertising accounts

- Running the traffic

- Calculating actual fees for virtual cards

We have tried to perform complete comparison tables for maximum clarity plus there are final thoughts in the end. The following article contains different categories including the Sign-up and Login process, Cards and BIN, Fees, Traffic test, and the conclusion on which virtual payment card is best suitable for you.

Before we get along with the whole article revolving around the tools and everything, here is a small section on why Virtual cards have made their way around marketing.

Using Virtual Cards for Online Marketing

If you're looking for a new and innovative way to market your business, you should consider using virtual payment cards. Virtual payment cards are a type of prepaid card that can be used to make online purchases. They're a great way to reach new customers and market your business to a wider audience. Plus, they're easy to use and can be customized to fit your needs.

To use a virtual payment card, you simply load it with funds and then use it to make purchases online. You can use them to buy advertising space, pay for social media marketing, or even to purchase goods and services from other businesses. Virtual payment cards are a great way to get the most out of your marketing budget.

1. Login and Signup

As every journey starts from the first step, working with a payment service starts with registration. Let’s compare what data is needed for access to the chosen payment services, we have listed an extensive comparison between myBrocard, PST.net, and Capitalist, so let's get started!!

| Topics asked | Brocard | PST.NET | Capitalist |

| + | + | + | |

| Password | + | + | + |

| Name | + | Not required | Not required |

| Nickname | Not required | Not required | + |

| Country | + | Not required | Not required |

| Company | + | Not required | Not required |

| Monthly spend | + | Not required | Not required |

| Number of cards needed | + | Not required | Not required |

| Target services | + | Not required | Not required |

| Type of account | Not required | Not required | + |

| Field of activity | Not required | Not required | + |

| Website | Not required | Not required | + |

| Telegram | + | + | Optional |

| Skype | Not required | Optional | Optional |

| Phone number | Not required | Not required | Optional |

| Google Authentication | + | + | – |

| Telegram authentication | – | + | – |

| Facebook Authentication | + | – | – |

| Time to get a card | 1-3 days | Instantly | 2-3 hours |

Brocard (mybrocard.com) sign-up process and reviews

The sign-up process at Mybrocard is complicated by the need for an interview to gain access to the service. After completing the questionnaire, potential clients must wait for an interview. There is an invitation system as well. It is promised to respond to applications within 24 hours (Monday through Friday). To verify your identity, you must appear in front of the camera with your documents. It requires a little more effort to set up a call and pass KYC at Brocard. Perhaps there was some kind of technical issue, but we had to remind Brocard support about our verification request, as they have just forgotten about us.

During the interview, we were required to report the size of our team, traffic sources, budget plans, and partner networks as well as our preferred top-up methods. In addition, we were asked to provide screenshots of our ad account statistics. Now that we have access to virtual cards from Brocard, we must wait a little longer.

No one has written a Brocard review on Trustpilot. John, Alex, Mike, and Rob all gave Brocard a positive review to encourage customers to sign up for their services. You can log in using either a login and password or a Facebook or Google account.

PST.NET (pst.net) Sign up Process and Reviews

The PST sign-up process (pay, store, and transfer) was much easier. The first card and all subsequent expenses were less than $500 and didn't require KYC. We verified our account because we expected to spend more. Verification at PST took us over an hour, and we had a chance to test the platform for team accounts ($1 per card, with a 2 percent top-up commission on top of that). The Trustpilot overall service rating is 4.3 (outstanding). Customers can log on using a password or by using a Telegram or Google account.

Capitalist (capitalist.net) Sign up Process and Reviews

When registering as an individual or a business, the Capitalist payment system provides us with six data fields (for individuals) or seven data fields (for businesses). It takes a long time to verify the documents (we spent around two to three hours on it). The service rating on Trustpilot is 4.2 (excellent). No innovation is present in terms of login and password, which is the only way to access the service.

2. Cards and BIN

What is the most important part of a virtual card service? Sure, the quality of the cards. We are keen on what BIN, payment processing, and card types these services offer.

| Cards | Brocard | PST.NET | Capitalist |

| Country of BIN | USA | USA, EU | UK |

| Payment processing | Mastercard | Visa, Mastercard | Mastercard |

| Number of BIN | 3 (4?) | 10 (25?) | 1 |

| 3DS Support | Yes, with conditions | Yes | Yes |

| Apple Pay / Google Pay Support | No | Private | No |

| Currencies | USD | USD, EUR (GBP) | EUR |

Cards from Brocard

There are 3 BIN (USA) and 3 card types (USD only) available:

- 531367 Mastercard Credit Prepaid USD – for all permitted payments

- 539406 Mastercard Credit USD – same as above

- 555608 Mastercard Credit USD – cards with their own balance which are only suitable for paying for advertising services such as Google and Facebook Ads.

Support confirmed that there are certain cards that support 3D Secure authentication after 100 payments are made, “if the percentage of rejected payments is less than 10-15%”. Apple Pay and Google Pay cannot be used for offline payments.

Cards from PST.net

According to the website, there are 25 BIN and six card types available, and cards can be purchased in USD and EUR currencies. GBP cards are said to be available shortly, but only 10 BIN and four card types were available in our account. If you wish to use the rest, you will presumably want to contact customer support. Below mentioned are some of the other cards offered by PST that you might wanna check out:

- Premium Facebook Card (Mastercard/Visa) – card for Facebook Ads only, with trusted BIN and low fees, yet transaction fees are applied

- Advertisement Card (Mastercard/Visa) – for digital ads only (Facebook Ads, Google Ads, TikTok Ads, Taboola, Bing Ads, Apple Search Ads, etc)

- Universal Card (Visa) – universal card for any kind of payment

- 3DS Universal (Visa) – card for any payment operations with 3D secure support (code confirmation)

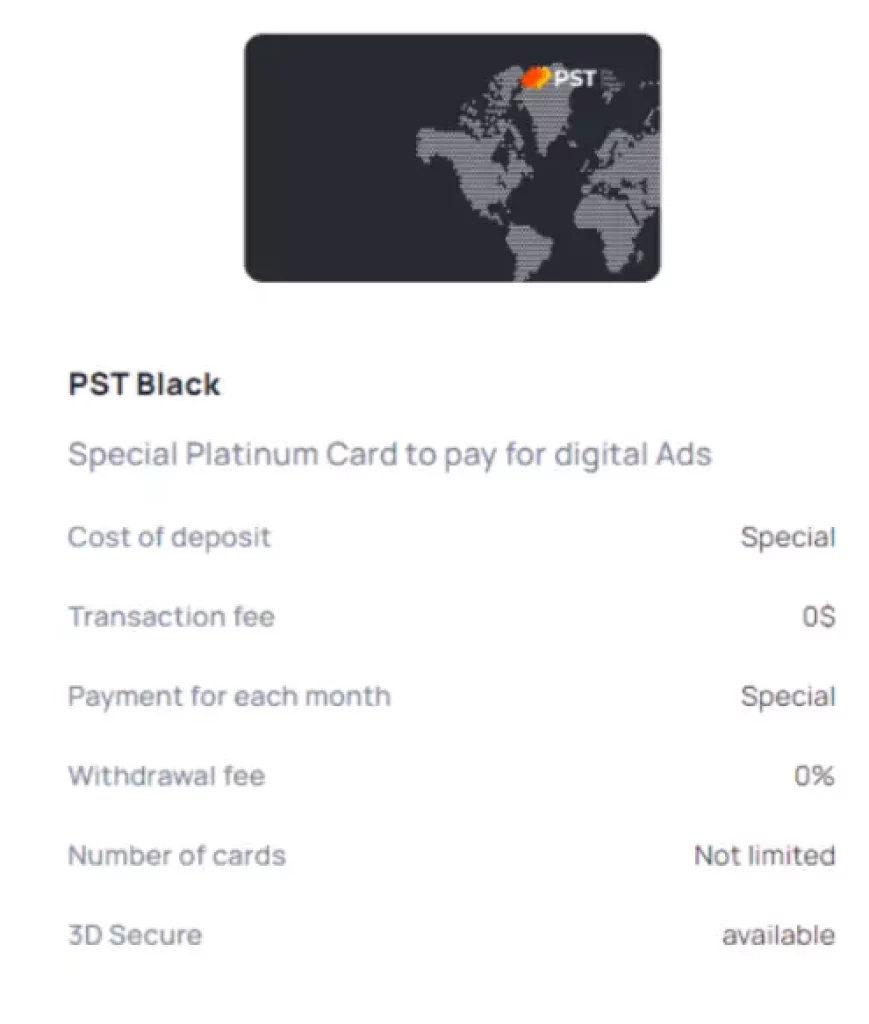

- Platinum Advertisement Card (Visa Platinum Credit) – card for digital ads only, with the most trusted BIN and special conditions (according to customer support). Available through support service only, with ad spend of more than 10 grand per month

- PST Black (???) – “virtual cards with Apple Pay support and ATM withdrawal, it’s private option for now, available via invites only” – that’s what we were told by the support after asking what type of card is this. Sounds interesting, as we have not met virtual cards with such options yet.

Cards offered by Capitalist

Only one type of card (EUR) is available, yet you can issue 100 at a time, but this is not so simple. To issue a card, you will need to get the “Verified user” status, and to get that status you will need to go through internal account verification (specify personal data, registration address and attach photos of documents). Support service comments: “further, when filling out an application for the issuance of a card, you can enter any cardholder data, the main thing is that the address must belong to one of the EU countries.

This information will not be checked additionally in any way. When issuing each new card, it is necessary to enter completely new data in the application (name, address, mail, phone number).” It's unclear why we need to do this, but okay. Capitalist virtual cards do not support 3D-Secure and Apple Pay / Google Pay.

3. Fees Charged from Virtual Cards Services

After the card is issued, the most important thing begins. Let's look at the terms and conditions of different payment services to see if we can save money.

| Terms | Brocard | PST.NET | Capitalist |

| Card issuance cost | $2.00 | from $1 | €8.55 |

| Crypto top-up fee | from 4% | from 2% | 8.2% |

| Local payment fee | None | None | €0.50 |

| Additional fees | 1% + $0.30 | None | None |

| Declined payment fee | $0.50 | None | None |

| Time to withdraw funds | 14-21 days | Instantly | Instantly |

| Free cards and other bonuses | 50 free cards for teams | 100 free cards for teams | None |

| Affiliate Program | None | Yes | Yes |

| Promo codes, coupons | None | Yes | Yes |

Fees Charged by Brocard

Capitalist (6%), USDT (4%), WIRE (3%), and Marketcall partner network (2%), all charge different fees for top-ups. Top-ups are maintained through a support ticket system. USDT automatic top-ups are accessible for trustworthy accounts only (yet there is no definition of ‘trustworthy' in this case). Capitalist requires a minimum of $500 and charges 7% for automatic balance top-ups (although it was 6% for balance top-ups using a ticket).

At the time of the article preparation the fees were the same for all basic BINs:

- US payments without fees

- Fees for payments outside the US – 1% + $0.30

- Declined payment fee – $0.50

- Card issuance – $2.00

Besides, there is a secret BIN 428816 with the following commissions being promised:

- US payments more than $50 and international payments over $70 – no fees

- US payments under $50 (fee $0.29), international payments under $70 (fee $0,70). Those fees apply even in case the payment is declined (Decline) due to the low card balance.

You must request assistance to withdraw money from the account. You must provide your USDT address and wait quite a while: support claims to deliver money in as little as three weeks, although the FAQ section says 14 days (temporary issues?). We were informed about the “50 free cards for new teams” promotion. There are no promotional codes.

PST Fees

Since there is no account reload commissions (specifically for each card type), there are card reload commissions (starting at 2%). If you deposit your account yourself using USDT-TRC20 (ERC20, BTC, and WIRE payments are supported), you can receive a direct WIRE transfer from the referral network. You can get an instant USDT deposit, whereas BTC requires two confirmations as always.

Other PST fees:

- US payments without fees

- Payments outside the US depend on the card bank rates

- Declined payment fees – none

- Card issuance cost – starting from $1

With USDT, withdrawals are processed without the aid of a support service. Withdrawals can be made for as little as $500. We found coupons for ‘free fifth card' and ‘first card free on first deposit without charge.' At the time of writing, there was an offer for media buying teams, where up to 100 cards were provided for free and subsequent cards cost $1 apiece, with a 2% deposit fee. This offer is available to media buying teams with $30k+ monthly ad spending.

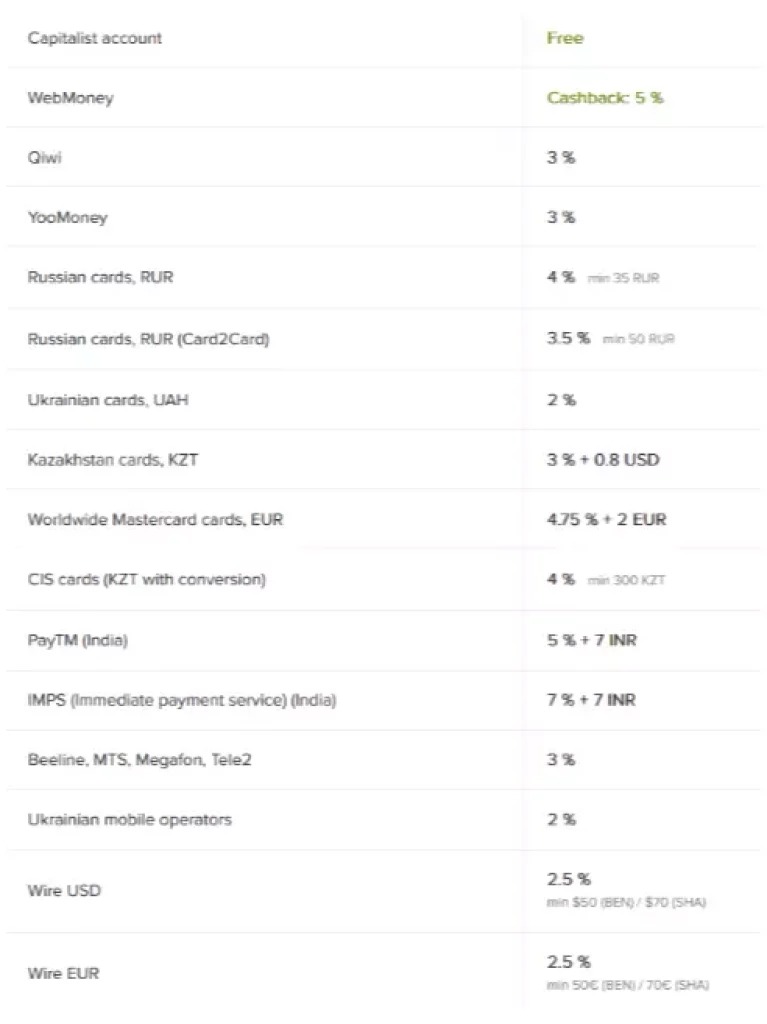

Capitalist Fees

Customers must verify their accounts to access crypto transactions (receiving funds, depositing funds). BTC, ETH, USDT (TRC 20 and ERC 20), and USDC deposits are all accepted. Bank transfers are free but only available to verified users with a business account (contract must be signed).

Other Capitalist fees:

- Transaction fee – €0.50

- Declined payment fee – none

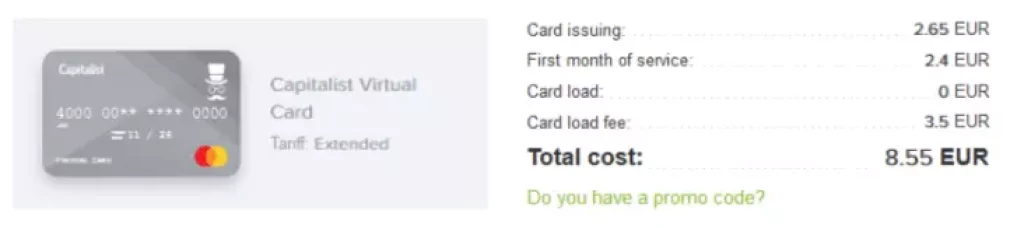

- Card issuance cost – €2.65 (maintenance fee €2.4)

- Additional services (payment search, wire payment refund, and SWIFT request) – all for €50

- Card top-up from Capitalist account – 4.7% (€3.5 minimum)

- Conversion fee – 3.5%

In fact, the price to issue the card turned out to be much higher – 8.55 euros instead of 2.65 euros.

Refund from virtual card to Capitalist account – €1.

Yet there are many options for funds withdrawal: in crypto and many more.

Let's start with crypto:

The first three options have “dynamic commission, which is updated every few minutes”:

- USDT Tether (ERC20) 0.35% + 5 USDT

- USDT Tether (TRC20) 0.35% min 2 USDT

- USD Coin (ERC20) 0.35% + 5 USDC

The most well-known cryptocurrencies have more stable commissions (no notes on dynamic updates):

- Bitcoin 0.0001 BTC

- Ethereum 0.25% (minimum 0.01 ETH)

What are the withdrawal options besides crypto?

There are bank transfers in USD and EUR, PayTM, and IMPS (Indian payment services), plus customers can withdraw the funds to a debit card from various countries (Mastercard Worldwide).

Customers can withdraw funds to a debit card from various countries (Mastercard Worldwide) through bank transfers in USD and EUR, as well as through PayTM and IMPS (Indian payment services).

No free cards at Capitalist were available at the moment this was written.

4. Traffic test

We first examined the cards' capacity to link to ad accounts (each card was linked to ten Facebook accounts). We then measured the performance of promoting Grats. Network gambling offers to tier 1 countries. Our own app solution was promoted in addition to Grats, Networks, everything was arranged by a veteran media buyer with extensive experience in Facebook ad campaigns, so there were no issues with the technical aspect of the test. The spending data we received for each virtual card service was average, but it could not be described as unequivocal—poor ads or other materials might have affected the results.

Speaking of consumables:

- Accounts from AXFacebook shop – Ukrainian accounts 1-2 months old (Premium accs with 2 BM and new FP)

- Spaceproxy proxies – mobile (GEO: UA)

- Anti-detect browser Indigo Browser (coupon code: GratsGroup. Thanks for that, Raf)

- GratsGroup apps

| Traffic testing | Brocard | PST.NET | Capitalist |

| Account linking (FB) | 10 out of 10 | 10 out of 10 | 10 out of 10 |

| Ads account suspension (week later) | 5 | 3 | 3 |

| Permanent account ban | 3 | 2 | 3 |

| Average ad spend | $516 | $704 | $227 |

| Real commission | 7-8% | 2% | 11,20% |

Brocard traffic test

Cards from Brocard were easily linked to all Facebook advertising accounts (10 out of 10), however, during the week of the test, 5 out of 10 accounts received an ad account suspension, after an appeal 3 were permanently banned. The average spend per account was $516.

It turned out to be very difficult to calculate commissions in the Brocard service – in addition to the fact that there are quite a lot of them (for account top-up, for USDT/USD conversion, for international payments), there are clearly non-obvious commissions (declined payments applied even on blocked and suspended cards) – as a result, the average commission on the service was 7-8%.

PST traffic test

Cards from PST were also easily linked to all FB accounts (10 out of 10). Week of testing, 3 out of 10 accounts received an ad account suspension, after an appeal, 2 received a permanent account ban. The average spend per account was $704.

The conversion of USDT/ USD was fixed at a 1-to-1 rate – as a result, the real fees turned out to be 2% during the test, since we got the plan for media buying teams ($1 for a card and a very low deposit fee – 2%, plus they give teams up to free 100 cards). This seems to be the lowest commission for virtual cards on the media buying market.

Capitalist traffic test

The cards from Capitalist, like the first two services, were linked to all FB advertising accounts (10 out of 10). During the week of the test, 3 out of 10 accounts received a ban on advertising activities, and after an appeal attempt, all three received a permanent account ban. The average spend per account was $227.

The real commission on the Capitalist service turned out to be the highest. Payments for transactions actually turned into an additional 3% commission, and together with the commission for top-up (4.7%) and the commission for conversion (3.5%), the service fee turned out to be 11.2%. Is it the price of a well-known brand?

5. Conclusions

Overall conclusion

- All the cards we tested were successfully linked to all Facebook Ads accounts (10/10). It’s up to you to decide whether our ads spend amount was meaningful.

- You need to be careful with any additional fees, as they might cost up to 70% of the overall service fees.

- All operations with financial services (Wise, Revoult, etc) are prohibited on all modern virtual card services.

- There are few cards with Apple Pay / Google Pay support

- 3DS is quite a rarity among virtual cards

Conclusions on Brocard

- Cards from Brocard can be “suspended” and blocked so that all debit operations are declined. The problem is that Facebook regularly charges a commission for each declined ad payment – $0,50. It would seem to be a small amount, but for each unpaid bill, FB tries to make up to 20 attempts to claim funds from the card. This is stated in the official FAQ, we give the guys a plus for this, but it does not solve the problem itself – in fact, this is another hidden service commission, which can increase operating costs by another 10-20%, and that is a serious problem.

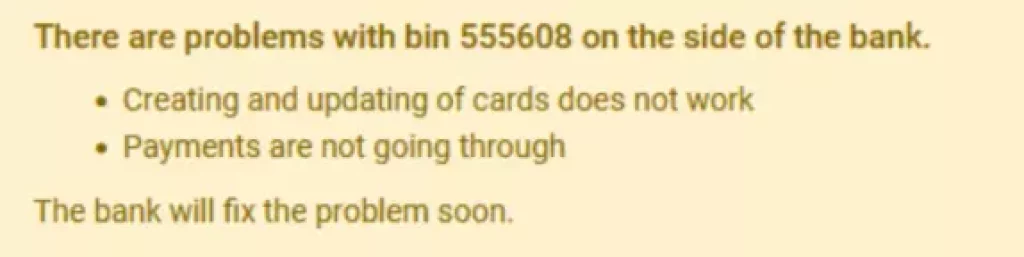

- At the moment the article was written one of BIN showed some instabilities. We hope it does not happen much often.

- Funny thing, there is no way to disable 2FA after it was activated. But that's more like merit from the security point of view (if you will keep your Google Authenticator safe).

Conclusions on PST

- Most BINs do not have Apple Pay / Google Pay support. That’s average.

- There is no option for payment category limits (by MCC code). Operations with financial services are prohibited as well (Wide, Revoult, etc).

- On the other hand, there is a great variety of BIN available, as well as a prompt sign-up process and attractive terms for media buying teams.

Conclusions on Capitalist

- Strict account verification requirements. Customers can not top-up the account or withdraw funds from it without full KYC.

- No 3D-secure support. That is not that important for media buying and digital ads, yet if the cards are meant to be used on other services, that might be a problem.

- The highest fee for card deposit (internal transfer fee + conversion fee + transactions fee) – at least 11,2%

Final Comparison | myBrocard vs PST.net vs Capitalist

| Index | Brocard | PST.NET | Capitalist |

| Card cost | $2.00 | From $1 | €8.55 |

| Crypto top-up fee | From 4% | From 2% | 8.2% |

| Local payment fee | None | None | €0.50 |

| Additional fees | 1% + $0.30 | None | None |

| Declined payment fee | $0.50 | None | None |

| Time to withdraw funds | 14-21 days | Instantly | Instantly |

| Free cards and other bonuses | 50 free cards for teams | 100 free cards for teams | None |

| Partner program | None | Yes | Yes |

| Promo codes | None | Yes | Yes |

| Country of BIN | USA | USA, UK | UK |

| Number of BIN | 3 (4?) | 10 (25?) | 1 |

| 3DS Support | With conditions | Yes | Yes |

| Apple Pay / Google Pay Support | No | Private | No |

| Trustpilot Score | No | 4,3 | 4,2 |

| Ad account linking (FB) | 10 out of 10 | 10 out of 10 | 10 out of 10 |

| Account suspension (after a week) | 5 | 3 | 3 |

| Permanent ban | 3 | 2 | 3 |

| Average ad spend | $516 | $704 | $227 |

| Real fees | 7-8% | 2% | 11,20% |

Virtual card services have become popular lately. After brief research into Brocard, PST, Capitalist, Soldo, Karta, Ezzocard, Ecards, 4×4, EPN, Multicards, Spendge, Adscard, LeadingCards, Yeezypay, Kartex, Funnel Dash, Juni, Flexcard, Lamanche Payments, and GCTransfer (among others, we're not sure), we realize that we can't see all of them. Brocard, PST, and Capitalist were chosen for the first comparison because they are well-known in the media buying community.

We'd also like to include all of the services in a table comparison, but it would take a lot of time, and traffic testing isn't cheap. If you like this format, let us know in the comments, and we'll test other virtual card providers for you (if you want a service tested in particular, please include its name here).

Content is free. When you buy through links on my site, I may earn an affiliate commission. Learn more

Awesome detailed review! Gonna try one of these