When it comes to boosting ROI, the simplest path often involves cost reduction. While finding the right offer and the perfect combination is crucial, selecting the right resources for an affiliate is equally vital. While the “trustworthiness” and “quality” of payment methods are often debated, the impact of fees is more tangible. In this article, we'll explore how choosing the right payment instrument can optimize ROI by 10-30% (or even up to 50%).

Increasing ROI with Virtual Cards

Experienced marketers understand that achieving a stable 30% ROI on significant volumes is a remarkable achievement. Let's illustrate how choosing the right payment option can enhance your ROI based on an average scenario.

ROI (Return of Investment) – This metric reflects the profitability of your advertising campaign and is calculated using the formula: ((Income – Costs) / Costs) x 100%.

If we consider the ROI formula, it's evident that with a 30% ROI and a mere 5% cost reduction, our profit surges by over 20%. Furthermore, a 10% cost optimization results in an almost 50% boost in ROI.

| Without optimization | Optimizing costs by 5% | Optimizing costs by 10% | |

|---|---|---|---|

| Income | 130 | 130 | 130 |

| Costs | 100 | 95 | 90 |

| ROI | 30,00% | 36,84% | 44,44% |

This article explores what's new in the world of virtual cards in 2023 and their direct influence on ROI.

1. Fees Across Different Virtual Cards

The potential to increase ROI is directly related to the size of Virtual Card (VCC) fees, which can range from 1-2% to 14% of your budget. We'll focus on four main fee categories:

- Account/Card Top-Up Fees

- The Cost of the Cards Themselves

- Cashback (if available)

- Transaction Fees (excluding international taxes)

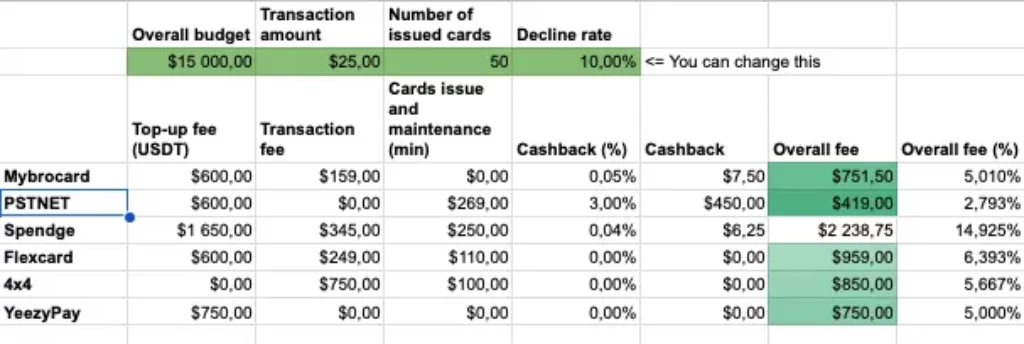

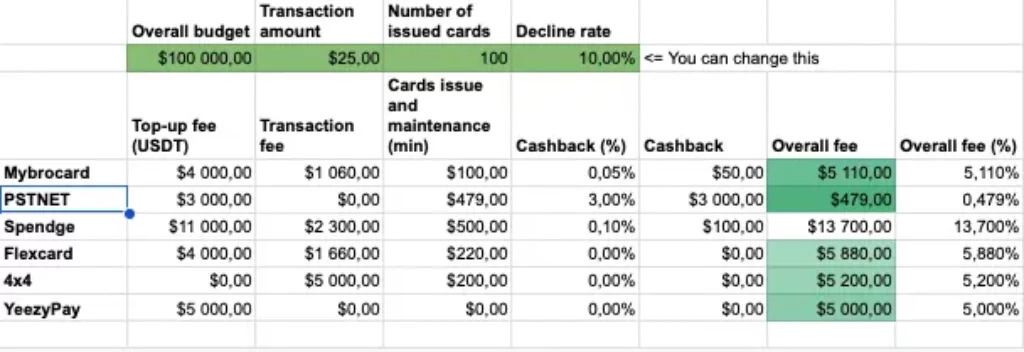

We'll rely on an interactive calculator to calculate the fees and benefits, ultimately revealing that PST.NET's Private program demonstrates the best results in terms of increasing ROI with a total commission rate of 0.4%, compared to 5-13% for other services.

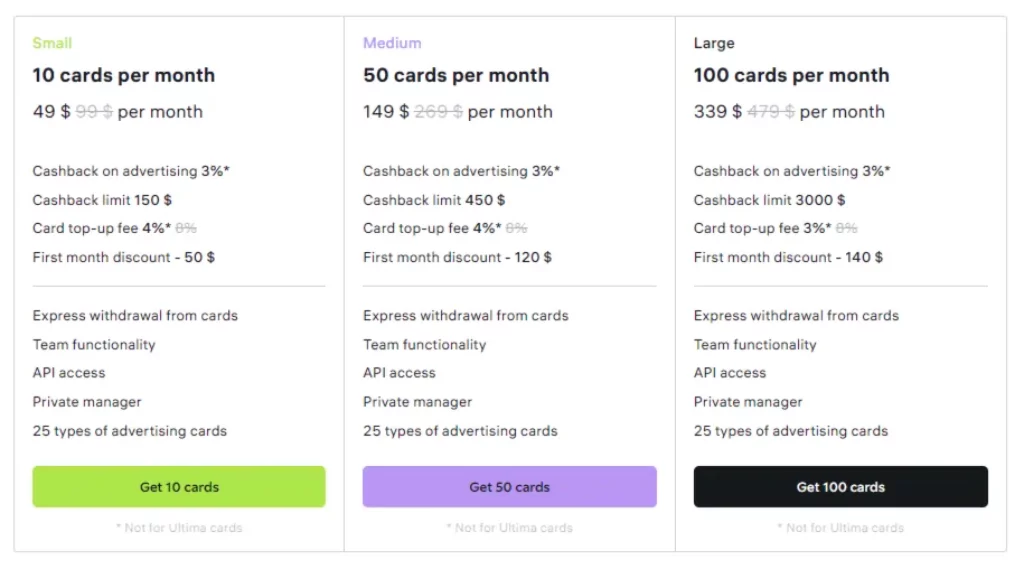

Private has transitioned to a subscription model and now offers a 3% cashback on advertising along with a package of free cards (from 10 to 100) every month.

The service offers three plans, each of which includes:

- A package of cards (up to 100, renewed monthly)

- A top-up discount of up to 3% (more favorable than other services)

- A 3% cashback

The cost for any plan remains the same as card issuance on other services, along with the lowest crypto top-up fee and cashback of up to $100k.

The benefits may vary depending on specific conditions, but we've considered them in the comparison table, allowing you to explore various scenarios.

All program participants will also have access to a familiar but important set of perks: teamwork functions, API access (otherwise you would have to pay $500 for it), and, of course, a Private manager.

In conclusion, optimizing fees can significantly impact ROI, and PST.NET's Private program offers one of the most advantageous fee structures. Experimenting with different scenarios can lead to even more dramatic results.

2. Limits, BINs and Security

While we've discussed the remarkable growth in ROI, let's not forget the pivotal aspect of product features within virtual payment services. These platforms come with their own set of limitations, including minimum top-up requirements, maximum transaction thresholds, and spending constraints over time. In this segment, we'll delve into the specific characteristics of today's top contenders, weighing their advantages and disadvantages.

Unlike many affiliate payment providers, PSTNET introduces a KYC verification process. It's worth noting that, during our subscription acquisition, the verification process occurred automatically. While it may appear as a temporary anomaly or perhaps a concealed feature, our confirmation remains uncertain. Furthermore, an additional $5 fee applies when topping up to $50, attributed to transaction fees for small cryptocurrency amounts. PSTNET users are also presented with a list of prohibited Merchant Category Code (MCC) categories, such as financial products and services, restricting the use of virtual cards in these domains. Additionally, PSTNET currently exclusively offers cards in dollars.

In contrast, other services often adopt more straightforward methods such as interviews or monthly spend confirmations instead of a verification process. Additionally, many of these services offer two-factor authentication (2FA) options, typically through Google Authenticator or their proprietary Telegram bot.

Now, let's dive into the intriguing world of BINs (Bank Identification Numbers). These are the first 6 or 8 digits of a card number, often regarded with mystique, from unlocking special privileges to facing bans on various platforms. Predicting how a specific BIN will interact with your setup is challenging. However, payment providers with a higher quantity of BINs that frequently introduce new ones tend to offer more experimentation opportunities.

| Flexcard | Mybrocard | PST.NET | Spendge | 4×4 | |

|---|---|---|---|---|---|

| How many BIN | 8 | 23 | 25 | 5 | 2 |

| When was the last update | Several months ago | September 2023 | July 2023 | Couldn’t identify (long ago) | Couldn’t identify (long ago) |

The frequency and diversity of BIN updates play a pivotal role in determining their effectiveness. While most services limit their product lines to a dozen positions, PST.NET stands out with a generous offering of 25 BINs. Of these, three feature 3D Secure (3Ds) technology, two operate in automatic mode, and they are categorized under “for TikTok.” The 3Ds codes for the third category are readily accessible through the interface, Telegram, and email. In July 2023, PST.NET last updated its product line, removing several Euro BINs. The PST BIN checker Pulse empowers users to assess the Decline Rate themselves.

Virtual payment services are expanding their horizons beyond being tools exclusively for media buyers. They're now offering users a more versatile “Basic Affiliate Kit,” encompassing proxies, design service subscriptions, neural networks, VPS, and more. Although the primary use cases for these cards often revolve around marketing, some services have widened their scope. PSTNET, for instance, imposes specific restrictions on MCCs, whereas other services provide lists of approved categories. Surprisingly, one of the few licensed products on the market extends beyond specialized cards for affiliate marketing, encompassing everyday expenses as well.

MyBroCard offers both cards for service payments and specialized ones for advertising, and BINs and cards are not separated by platforms. They have a total of 23 cards, all in dollars, and some have 3Ds enabled. However, it's mostly in auto-mode: the card will pass verification through AWS, but you won't be asked for a code. New positions are added regularly, with the latest one released just a few days ago. They don't advertise restrictions on merchants, but they are certainly present: some payments are declined due to “Unknown Merchant,” even though there is a balance on the card.

Conclusion

In conclusion, the virtual card market is in a state of evolution in 2023, transitioning from tools for media buyers to sources of income from web traffic. While services offer cards to users, the reliability of these cards remains a point of debate among affiliates. Ultimately, only rigorous testing can determine which cards align best with your specific setup. The choice between viewing cards as tools that consume up to 13% of your advertising budget or as instruments to boost profitability lies in your hands, dear readers.

Content is free. When you buy through links on my site, I may earn an affiliate commission. Learn more